First, let’s take a step back and look at the do-it-yourself (DIY) movement in general. Though the name is very modern, the concept of amateurs doing trade work has been around since – it seems – forever. However, in recent years the trend has skyrocketed, and in fact, millennials are leading the DIY phenomenon. They often buy older homes that they hope to upgrade to modern standards.

If you’re part of this lively community of handymen and women, getting a renovation loan is still a great option to have open when you eventually need to hire a pro.

The Limits of Doing It Yourself

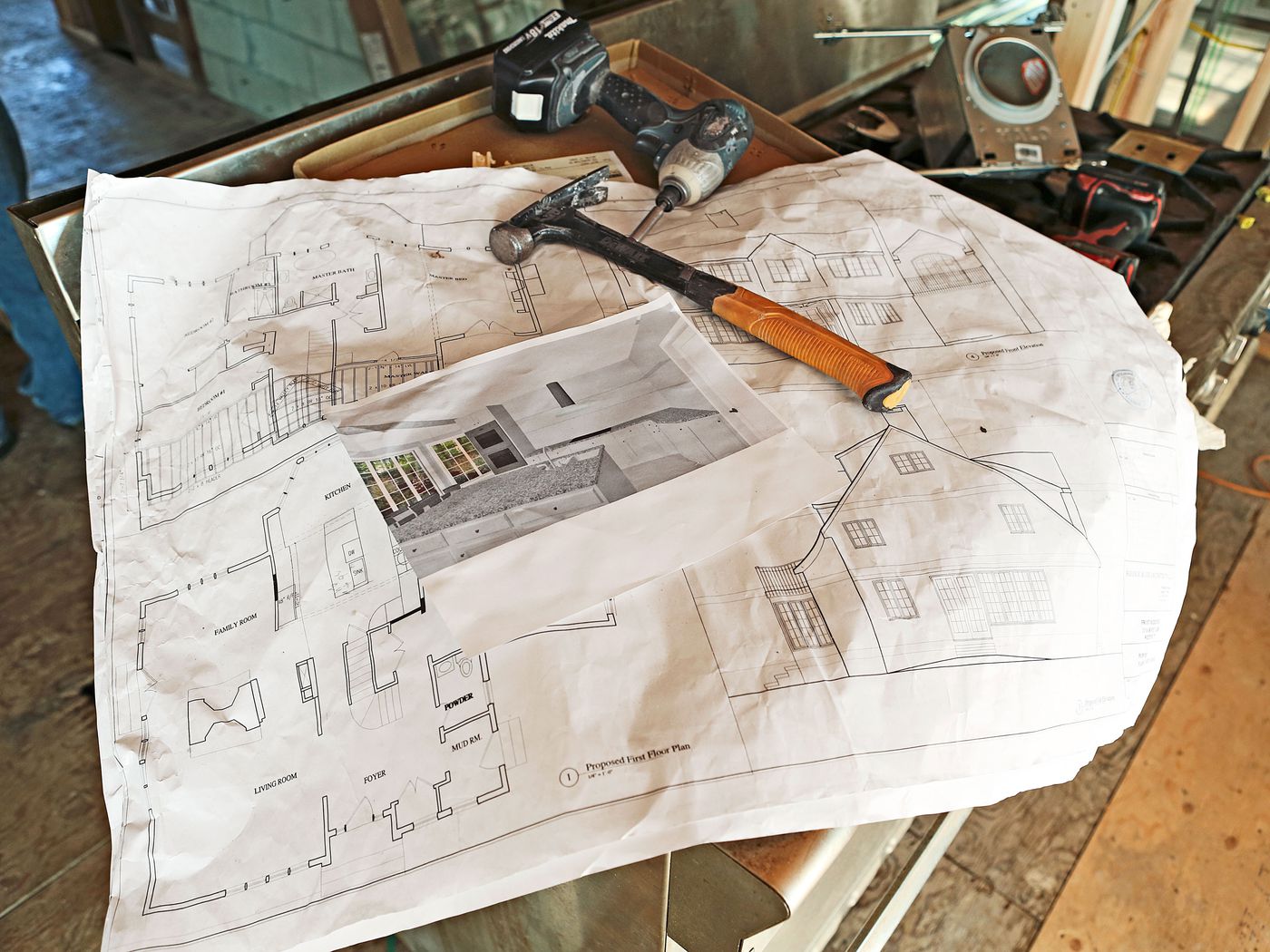

Before you decide whether to DIY or not, it’s essential to set your expectations for the finished project. What’s the scope of the change? Will it affect other parts of your home? And maybe most importantly, how do you want it to look? Ask yourself these questions to get a firm understanding of what you may be getting yourself into. You may even want to use a sketchbook.

For projects like painting your hallway, answering these questions brings you to a very low-stakes conclusion. Painting requires skill, but you can likely handle the task. If it doesn’t turn out how you envisioned it, the rest of the house will still function, and you can always try again.

Not every project is like that, and some require skills gained from education and years of real-world experience. For example, if you are experiencing electrical issues, you can be putting yourself at serious risk if you DIY and aren’t 100% sure what you’re doing. But, even if you are, inherent dangers exist in that kind of work – either yourself or your home.

In cases where your safety is in question, or you don’t have the skillset to take on a project, you can fund a professional contractor with an FHA 203(k) renovation loan.

How To Use an FHA 203(k) Renovation Loan

Part of the larger Federal Housing Administration (FHA) mortgage program, an FHA 203(k) loan is designed to offer funding with flexible credit and debt-to-income ratio requirements. This means that it’s easy to qualify for this kind of loan, and because it’s a mortgage loan, you can expect highly competitive rates.

An FHA 203(k) loan is specifically meant to pay for major or minor home repairs. When considering this loan solution, keep in mind that it:

- It is only applicable to primary residences

- Focuses on repairs and fixes as opposed to “luxury” improvements

- Establishes an escrow account that holds the money for your contractor

Types of FHA 203(k) loans (Standard and Limited)

There are two types of FHA 203(k) loans: the limited and the standard.

The FHA 203(k) limited, as the name may suggest, cap its funding at $35,000 and will help fund cosmetic changes. This can mean, for example, new carpeting, a fresh coat of paint, or the purchase and installation of appliances. Think of these as repairs that can be done while the house is still habitable.

An FHA 203(k) standard loan funds several major renovations. They also cover structural changes that cost at least $5,000. The cap varies depending on the community. With this loan option, you can replace, construct or demolish different parts of your home.

Choosing To Use a Renovation Loan

FHA 203(k) loans are incredibly robust and can be an excellent option for some of the most enthusiastic DIYers.

If you’re a professional contractor or feel you’re up to the renovations ahead of you, enjoy the process and learn as much as you can. However, when a project may look like more than you can handle, contact a mortgage professional and discover what renovation possibilities are open to you.